April 18, 2017

MCAW Sheds Light on How Walmart Costs Taxpayers

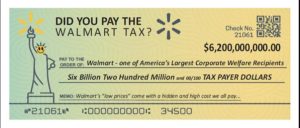

This month, Making Change at Walmart (MCAW) launched a campaign to highlight the “hidden tax” every taxpayer has been paying for years to Walmart. According to Americans for Tax Fairness, the retail giant receives an estimated $6.2 billion in subsidies every year, primarily from the federal government.

An op-ed titled “The Walmart Tax Every American Taxpayer Pays” by UFCW Local 1529 President Lonnie Sheppard was published in USA Today on April 8, and highlights many of the key facts that Walmart refuses to acknowledge, like the high cost and hidden tax that every American taxpayer pays every single day.

Among the key facts:

- Walmart, a company that generates almost $500 billion in revenue every year with annual profits averaging $15.5 billion over the last five years, is also one of the nation’s largest welfare recipients.

- According to a 2014 report by Americans for Tax Fairness, Walmart receives an estimated $6.2 billion in subsidies every year, primarily from the federal government.

- Even though Walmart claims that it spent $500 million on hourly associate bonuses and recently boosted employee wages, it still has thousands of employees who rely on public assistance programs like food stamps, Medicaid, and subsidized housing.

- A single Walmart Super Center is estimated to cost taxpayers between $904,542 and $1.74 million per year in public assistance money.

- Logically, if Walmart increased employee wages, and/or provided better benefits, much of this $6.2 billion dollar burden would be lifted off the taxpayers.

MCAW also ran digital ads targeting shoppers and workers inside stores across the U.S., and MCAW organizers have been exposing the Walmart tax to shoppers and workers across the country. Thank you to all UFCW local and regional staff that worked on this project.